A growing surge of federal recycling incentives for solar panels is reshaping the clean-energy economy and redefining how businesses approach sustainability commitments across the United States.

As millions of solar panels approach the end of their lifecycle in the coming decade, federal lawmakers are rolling out new tax benefits that encourage companies to recycle, refurbish, and repurpose aging photovoltaic systems. This policy shift establishes a new framework for solar waste management while unlocking opportunities for commercial energy developers, recycling facilities, and corporate sustainability leaders.

A New Federal Push: Why Solar Panel Recycling Matters Now More Than Ever

Solar energy represents one of the fastest-growing renewable sectors in the world. But with massive deployment comes an equally massive challenge: what happens when panels reach the end of their 25- to 30-year lifespan?

Until recently, recycling infrastructure in the U.S. lagged behind rapid solar adoption. Many panels ended up in landfills due to high recycling costs and limited processing facilities. As the volume of decommissioned panels increases, federal officials are introducing substantial tax incentives to ensure solar recycling becomes both economically viable and environmentally responsible.

These new programs are designed to:

- Reduce landfill waste

- Support domestic recycling businesses

- Recover valuable materials such as silver, silicon, and aluminum

- Encourage circular-economy practices across the solar industry

- Lower the environmental impact of renewable-energy deployment

By incentivizing recycling, federal policymakers aim to transform an emerging waste problem into a long-term economic opportunity.

Read Also: Solar Microgrid Tax Incentives 2025: New Funding Powering Schools & Public Infrastructure

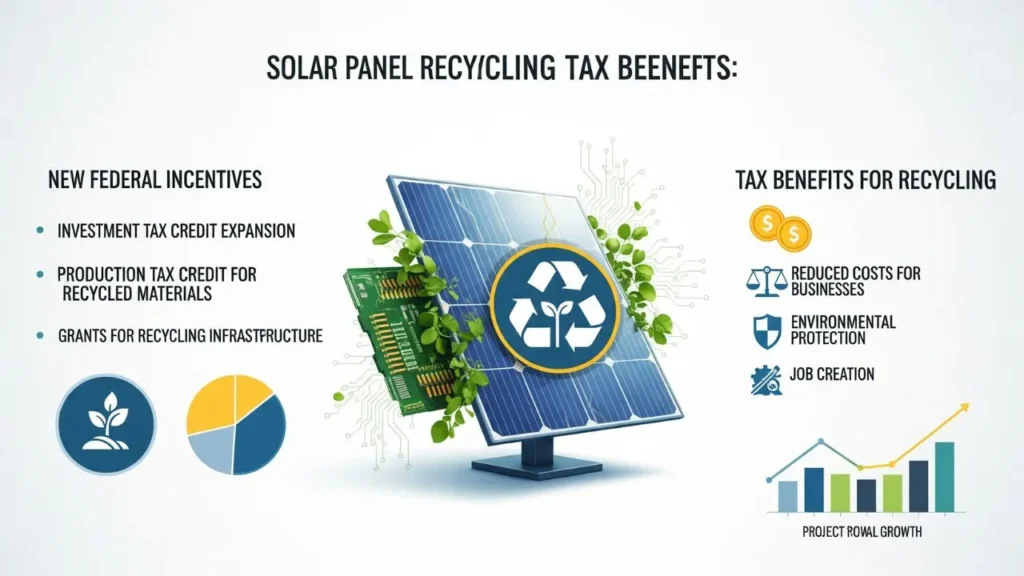

Understanding the New Solar Panel Recycling Tax Benefits

The new federal tax incentives focus on lowering the financial burden associated with collecting, transporting, and processing used solar panels. Businesses, manufacturers, and recycling centers may now qualify for tax credits, accelerated depreciation, and production-based benefits tied to recycling operations.

These benefits include:

1. Recycling Investment Tax Credit (R-ITC)

Modeled after the existing solar Investment Tax Credit (ITC), the R-ITC offers a percentage-based credit on investments related to solar recycling assets. Eligible expenditures may include:

- Recycling equipment

- Treatment and processing systems

- Facility upgrades

- Depollution and material recovery technologies

This credit encourages companies to expand recycling capabilities or build new processing facilities in the U.S.

2. Production Tax Credits for Recovered Materials

Facilities that recover critical minerals — including silicon, silver, copper, and rare earth metals — may qualify for performance-based production credits. These credits reward efficient recovery and processing, helping lower operational expenses while boosting material supply for future solar manufacturing.

3. Bonus Credits for Domestic Recycling Operations

To encourage local job creation, the federal government provides bonus credit rates for recycling facilities operating in the U.S. These bonus credits support domestic economic growth while strengthening national resource independence.

4. Accelerated Depreciation for Recycling Equipment

New investments in eligible recycling technology may qualify for rapid depreciation schedules, significantly reducing tax liability in the first years of operation.

5. Grants and Federal Funding Opportunities

In addition to tax credits, federal agencies are offering grants to support:

- Recycling research

- Workforce development

- Advanced material recovery projects

- Circular-economy innovation

These combined incentives are shaping a thriving new industry centered on solar waste recovery.

How These Incentives Reshape the Solar Industry

Recycling incentives are more than financial perks — they represent a critical shift in how the solar sector manages long-term lifecycle planning.

Creating a Closed-Loop Solar Economy

One of the biggest benefits is the creation of a closed-loop supply chain. Recycled materials can be used to manufacture new solar components, helping the industry reduce dependence on imported minerals and global supply chains.

This reduces costs, minimizes resource scarcity, and creates a more sustainable production cycle.

Lowering Environmental Impact

The new incentives dramatically reduce the amount of solar waste entering landfills. By extracting valuable materials and safely disposing of toxic elements, recycling facilities help:

- Reduce soil and water contamination

- Lower carbon emissions related to mining

- Support the nation’s broader climate targets

Reducing Long-Term Developer Costs

As recycling capacity increases, commercial developers benefit from reduced end-of-life disposal costs. This strengthens project feasibility and lowers the total cost of ownership for solar installations.

Creating New Green-Energy Jobs

The tax benefits are expected to spur rapid growth in:

- Recycling plant construction

- Materials engineering

- Solar equipment refurbishment

- Environmental services

- Supply chain logistics

This positions the U.S. as a global leader in solar waste processing and recovery.

Impact on Commercial Solar Developers and Corporate Sustainability Programs

Commercial developers are among the biggest beneficiaries of the new federal incentives. Recycling tax credits help them align renewable-energy expansion with cost-efficient end-of-life planning.

Lower Compliance Costs for Decommissioned Systems

Regulators are increasingly requiring responsible disposal of solar equipment. With new tax benefits, businesses can comply without facing steep financial burdens.

Stronger ESG Reporting and Investor Confidence

Companies pursuing environmental, social, and governance (ESG) goals gain measurable sustainability achievements by adopting recycled materials and responsible end-of-life practices.

Highlighting recycling compliance often enhances investor trust and public reputation.

Improved Access to Financing

Banks and energy investors prefer projects with clear, cost-effective lifecycle plans. Incorporating recycling incentives into solar proposals can result in:

- Higher project approval rates

- Better loan terms

- Lower risk premiums

Opportunity for Long-Term Savings

When paired with federal solar deployment incentives, recycling tax benefits create a comprehensive financial model that lowers cost from installation to decommissioning.

Challenges: What Businesses Must Know to Qualify

Despite the advantages, securing these incentives requires careful adherence to federal guidelines.

Detailed Documentation Required

Companies must track:

- Material recovery percentages

- Recycling methods

- Certifications from processing facilities

- Transport and collection processes

- Compliance with environmental standards

Limited Existing Recycling Infrastructure

Although expanding rapidly, some regions may still lack nearby recycling facilities. Transportation costs and logistical planning remain critical factors.

Complex Eligibility Rules

Different tax credits have different requirements. Businesses must understand:

- Which recycling activities qualify

- Which materials count toward production credits

- How to structure investments to maximize benefits

Due to these complexities, many companies now rely on specialized consultants to help navigate the process.

Future Outlook: The Rise of Solar Recycling Innovation

The federal incentive wave is expected to ignite major technological breakthroughs as companies invest in advanced recycling capabilities.

1. Increased Recovery Efficiency

Emerging technologies are aiming to recover over 95% of valuable materials from end-of-life solar panels — a significant improvement over current averages.

2. Expansion of U.S. Recycling Plants

With tax benefits offsetting construction and equipment costs, new facilities are expected to appear across:

- California

- Texas

- Arizona

- New York

- The Midwest manufacturing corridor

3. Growth of Refurbished Solar Markets

Panels that still retain performance capacity may be refurbished and resold at lower cost, particularly in:

- Rural markets

- Off-grid communities

- International development regions

4. Strengthening of Domestic Manufacturing

Recovered materials like silicon and silver can support U.S. solar manufacturing growth — reducing dependence on imports and stabilizing supply.

Read Also: Commercial Solar Tax Credit Bonus Rates for U.S. Manufacturing

Case Examples: How Businesses Are Already Benefiting

Example 1: Utility-Scale Developer

A large energy developer adopted a recycling plan for its decommissioning strategy.

Result: Significant tax savings on recycling infrastructure and enhanced investor interest in long-term sustainability.

Example 2: Corporate Solar Rooftop Portfolio

A national retail chain established a recycling agreement for aging panels in several states.

Outcome: Reduced lifecycle costs and improved ESG ratings for shareholders.

Example 3: Recycling Startup Expansion

A recycling startup leveraged federal credits to expand its facility and add new recovery equipment.

Impact: Increased processing capacity, new jobs, and stronger partnerships with solar developers.

Conclusion: A Pivotal Shift in America’s Renewable-Energy Future

The introduction of solar panel recycling tax benefits marks a major turning point in U.S. clean-energy policy. These incentives create an economic framework that rewards sustainability, encourages responsible lifecycle planning, and strengthens the domestic circular economy.

For businesses, the opportunity is clear: by participating in this new incentive wave, companies can reduce costs, support innovation, enhance ESG leadership, and help build a cleaner, more resilient energy future.

3 thoughts on “Solar Panel Recycling Tax Benefits: New Federal Incentives”